The announced rise in semiconductor prices in 2026—often referred to as “chipflation”—is far more than a budgetary constraint for industrial players.

It marks a strategic turning point for B2B and B2G companies able to position themselves as reliable partners rather than passive victims of the market.

In 2026, the challenge is no longer just about protecting margins, but about rebuilding the value proposition around supply resilience and technological transparency.

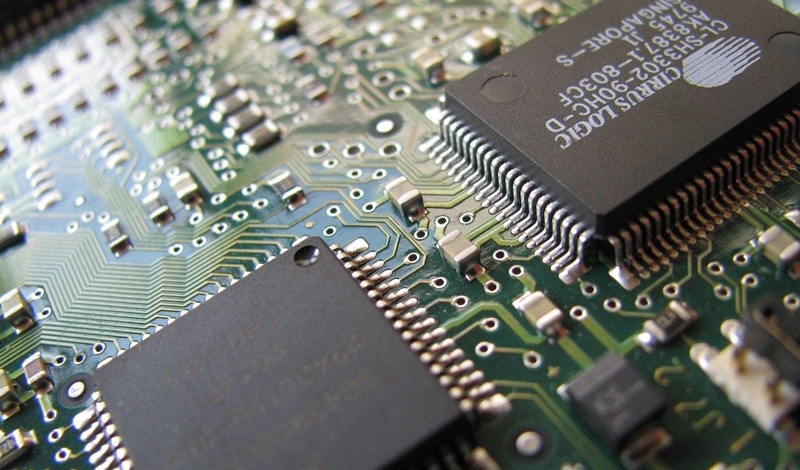

The context: a structural, multi-year price increase

The signal is now clear. Major foundries have committed to a long-term upward pricing trajectory, particularly for advanced nodes, with increases starting in 2026 and extending over several years.

This trend is driven by relentless demand from artificial intelligence, high-performance computing, and data center infrastructure.

The main risk for traditional industrial sectors—defense, aerospace, energy—lies in capacity reallocation.

Foundries increasingly prioritize leading-edge technologies at the expense of intermediate nodes that remain critical for industrial systems, creating cascading tensions across the entire supply chain.

The trap facing “smaller” industrial accounts

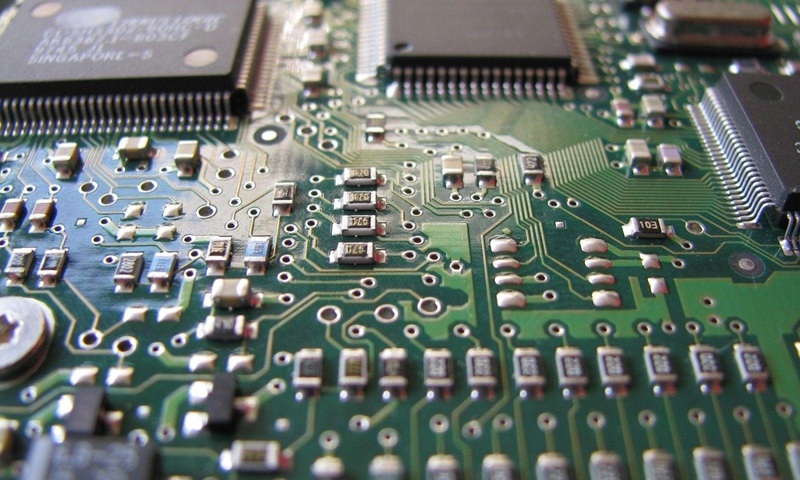

For OEMs designing embedded computers, smart sensors, or mission-critical systems, chipflation translates into rapidly rising BOM costs and painful trade-offs between performance, availability, and lead times.

On the ground, mid-size industrial players are the most exposed.

Competing with AI giants that capture production capacity and negotiate preferential terms, European equipment manufacturers must shift gears. Failing to secure upstream supply today means accepting the risk of being served last—or not at all—in 2026.

Why many industrial players will miss the resilience shift

Technological excellence alone is no longer sufficient if it is not paired with supply-chain agility.

Several recurring mistakes are likely to prove extremely costly by 2026.

- Single-sourcing by convenience: designing products around a single, non-substitutable component brings production to a halt when shortages occur

- The just-in-time illusion: assuming buffer stocks will absorb a structural and long-term shortage

- Lack of transparency: hiding critical dependencies from customers, when trust has become a decisive factor in B2G markets

In a prolonged shortage environment, these are no longer optimization choices but strategic risks.

Three levers for a resilient product roadmap

Turning chipflation into a competitive advantage requires activating several structural levers immediately.

Explicit technology segmentation

Product portfolios must be clearly differentiated.

On one side, “leading-edge” solutions accepting higher costs for maximum performance.

On the other, robust and available offerings built on mature nodes, ensuring continuity for vital infrastructure such as energy and transport.

Design-to-multi-sourcing

Boards and modules should be architected to support multiple qualified component references.

Planned functional downgrade options enable delivery of operational products even when cutting-edge components become unavailable.

Internal standardization of building blocks

Reusing common technology blocks across product lines increases purchasing volumes, strengthens supply security, and enables rapid pivots without full requalification at every market disruption.

Turning constraint into a value argument

For institutional customers and infrastructure operators, the primary pain point is not unit price—it is delivery risk.

This is where differentiation becomes decisive.

Equipment manufacturers can stand out by emphasizing:

- Long-term availability agreements covering reserved capacity and component migration support

- A documented continuity plan detailing foundries, technology nodes, and qualified backup BOMs

Past crises have shown that companies anticipating redesign-to-availability continued delivering while competitors announced lead times exceeding one year.

In 2026, the financial stakes will be significantly higher.

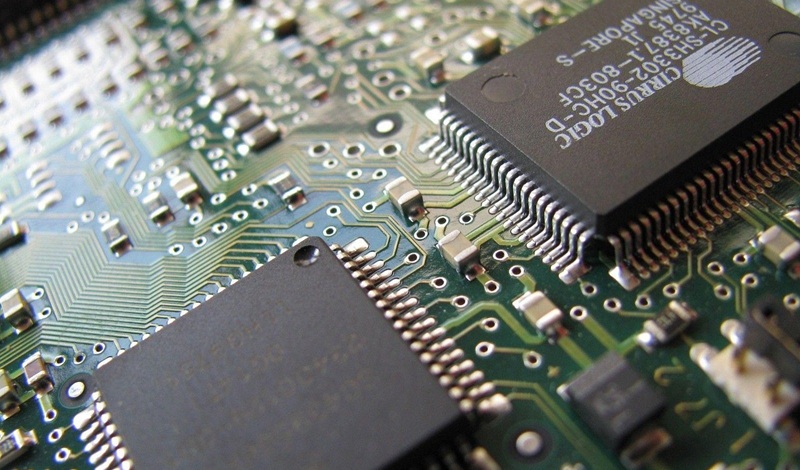

Conclusion – Silicon as a strategic pillar

In 2026, the real inflation is not energy—it is silicon.

Securing semiconductor supply is no longer a logistics task; it is a central pillar of the industrial value proposition.

The core question is blunt but unavoidable: is your product roadmap designed to shine on a datasheet, or to be delivered at all costs in a world of scarcity and rising prices?

If performance comes without delivery guarantees, you are no longer selling a product—you are selling risk.